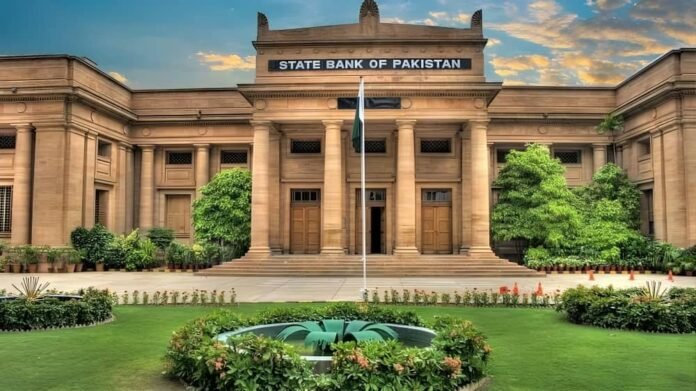

Karachi: The State Bank of Pakistan has submitted its monetary coverage, incorporating a selection to lessen the hobby fee by 1—five percent.

According to the financial coverage declaration issued by the State Bank of Pakistan, the hobby price has been reduced by 1.5 percent, from 22 percent to 20.5 percent.

The economic policy statement stated that the interest rate has decreased by 150 foundation points. In May, inflation remained at eleven eight percent, while tight financial policy and reduced food costs slowed it down. The outturn for May was better than expected.

The assertion stated that inflation fell quickly of expectations in May because of tight money delivery and decreased meal costs; however. This can alternate with budgetary measures and energy or fuel tariff revisions threatening destiny inflation quotes. This might also upward thrust significantly at some point in July 2024 but later fall over the financial 12 months of 2025.

Inflation remained at 11.8% in May, while tight monetary policy and a decline in food prices helped slow it down. This is better than expected for last month’s performance.

It’s important to note that the benchmark interest rate has remained unchanged at 22% since June 25, 2023. The recent reduction in the rate is a strategic move by the authorities to stimulate economic growth and curb inflationary pressures. This decision is expected to encourage borrowing and investments, thereby boosting economic activities in the country.

However, it’s crucial to note that lowering rates could also fuel price pressures. Therefore, policymakers must exercise caution and closely monitor key indicators before further adjusting. They must both promote employment opportunities through expansionary policies and maintain price stability. Consider current global market trends and domestic factors such as labor market conditions.

The authorities decided to promote industrialization. Enhance productivity levels across all sectors and deepen financial inclusion, especially among women entrepreneurs. And increase access to affordable housing finance for low-income households, particularly. Those residing in peri-urban areas around major cities like Karachi. Demand outstrips supply mainly because developers find it difficult to obtain land titles from various government agencies. Hence resorting to illegal settlements. Which often lack basic amenities such as water supply networks, etcetera.