Karachi: Bad News for Those Paying Heavy Electricity Bills in Installments

In a development that has dissatisfied many strong clients, the ones who’ve been counting on installment plans to manipulate. Their heavy energy bills will now face new restrictions. The National Electric Power Regulatory Authority (NEPRA) has introduced modifications in an effort to restrict clients. Ability to pay their energy bills extensively.

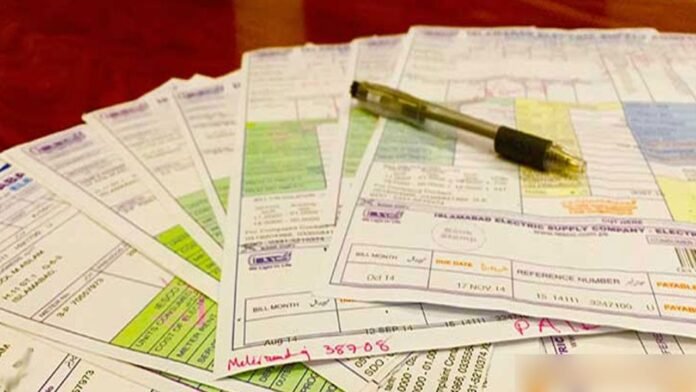

Until now, clients who determined it difficult to pay their electricity payments in one pass. They could set up to pay their dues in installments, offering tons-wished comfort. And assisting them in manipulating their finances greater efficaciously. This facility was especially beneficial for those facing excessive electricity expenses. Allowing them to unfold the monetary burden over a greater prolonged duration. However, NEPRA has now determined to restrict this option, a circulate that is anticipated to affect many families and companies that have been relying on this remedy.

According to NEPRA’s latest directive, the installment facility for electricity bill payments will be limited to once a year. This means that purchasers will simplest be able to request an installment plan for their electricity invoice on a unmarried occasion inside a calendar 12 months. For the relaxation of the year, they may need to manage. Their payments without the choice of breaking them down into smaller, more viable quantities.

The decision comes as part of NEPRA’s amendments to the Consumer Service Manual. All electricity distribution companies have received communication about these amendments and must comply with the new regulations. NEPRA has instructed that when consumers arrange for an installment plan, they must receive a computerized new bill. This measure likely aims to ensure greater accuracy and transparency in billing, but it also introduces a layer of complexity to the process.

NEPRA’s decision has sparked concern among customers and various stakeholders. Many argue that the restriction on installment plans will place an additional financial strain on families already grappling with high power costs. Businesses, especially small and medium firms (SMEs), which function on tight budgets, may also find it tough to address the brand-new rules. The potential to stagger payments became visible as an essential aid mechanism for maintaining cash drift and monetary stability.

Additionally, NEPRA has clarified that these new guidelines will apply to all electricity distribution groups, including K-Electric, which serves a sizable portion of Karachi’s population. Clients throughout the U.S., regardless of their electricity provider, will face identical obstacles on installment bills.

Critics of the new policy have pointed out that electricity prices have been on the rise, and limiting the payment options available to consumers does not align with the financial realities many are facing. They argue that NEPRA should consider more consumer-friendly policies that take into account the economic pressures on households and businesses.

On the other hand, NEPRA defends the move by emphasizing the need for efficient and accurate billing methods. The regulator suggests that the new automated billing system will enhance transparency and help reduce billing errors, ultimately benefiting customers in the long run. However, whether these potential long-term benefits will outweigh the immediate financial hardships remains a topic of debate.

NEPRA’s choice to restrict the installment facility for energy bill payments to once every 12. Months mark a substantial alternative in how clients manipulate their electricity prices. While the move targets to streamline billing strategies, it poses new demanding situations for customers. Who is already handling excessive strength expenses? As those new rules come into impact, it will likely be vital to monitor. Their effect on households and companies and recollect if further adjustments are necessary to guide the monetary well-being of power consumers.