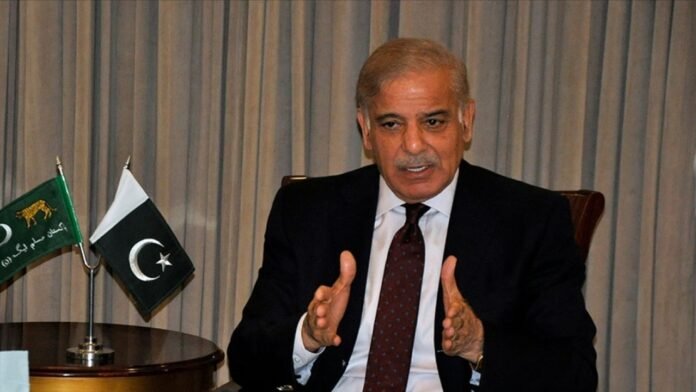

PM Muhammad Shehbaz Sharif has promised to give the Federal Board of Revenue (FBR) whatever it needs to digitize the tax system. During a top-level meeting, the premier discussed tax reforms, economic digitalization, and revenue enhancement measures.

Remarks by the PM

In his address to participants, Prime Minister Shehbaz Sharif said that FBR is an important part of the national economy. He promised the government would support human resource development and digitalization in FBR. The Prime Minister clarified that more efforts would be made against tax evasion. And those abetting such activities would be brought to justice.

Instructions for Elite

Prime Minister Sharif categorically stated that the elite must pay taxes. The Premier stressed the complete digitalization of the tax system and enhancing the workforce’s capabilities on a top-most basis.

Efforts to Widen Tax Net

Shehbaz Sharif also mentioned swiftly including eligible taxpayers in the tax net. It is part of a broader strategy to ensure widespread and efficient compliance with taxation laws.

Progress Briefing

During a separate briefing, international firms McKinsey and Karandaaz updated PM on progress made during the last four weeks. They presented short-term and medium-term revenue enhancement plans, including steps taken so far and future strategies towards strengthening the country’s tax collection framework.

Summary PM

This commitment by Prime Minister Muhammad Shehbaz Sharif towards providing full support for digitizing FBR represents one giant leap forward in modernizing Pakistan’s taxation system. The government hopes to create a more efficient and equitable environment for taxation through this move, where it focuses on digitization while at the same time improving human resource capacity within FBR coupled with expanding the taxpayer base. This initiative is expected to enhance the national economy and promote sustainable growth.