Former PMs and senior politicians Shahid Khaqan Abbasi and Miftah Ismail have complained that Pakistan’s present-day price range is the worst in its records. They said that 500 billion rupees were purportedly received by the assembly individuals using the IMF. However, they no longer suggested any taxes be levied on salaried individuals.

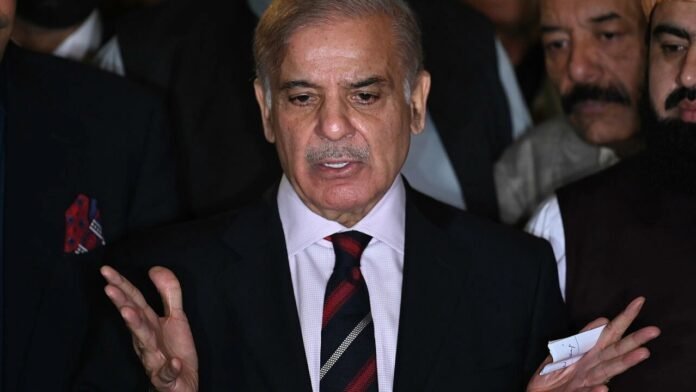

During a press conference in Islamabad with Miftah Ismail, Abbasi remarked, “The current budget will prove disastrous for Pakistan’s economy.” Criticizing the government’s budget, he said, “This budget cannot sustain the country’s economy. There should have been a uniform tax system, but the government is unwilling to reduce its expenditures.” He added that the government has stifled economic growth by imposing taxes on the salaried class and exporters. He pointed out that the government only collects taxes from the salaried class. The category of non-filers still exists in this budget and remains outside the tax net.

Abbasi emphasized that the government deficit is so high that there is no room for extravagance. He mentioned that the government will impose a 0.5% tax on sales for registered retailers, while unregistered ones will face a 2.5% tax, ultimately impacting the public’s pocket. He further criticized the government for not addressing the smuggling of LPG and diesel and the illicit sale of billions of rupees worth of cigarettes.

Such exemptions lead to public questioning. “Another perplexing matter is the imposition of taxes on the export sectors. Abbasi added that the government will impose a minimum of 1.5% to 2% tax when we need dollars the most.

Shahid Khaqan Abbasi questioned the government’s message to the salaried class: “Are you telling them to leave the country? The government will not cut its expenses but will burden you. How can the country run like this?” He criticized the elite for not imposing taxes on themselves while taxing others.

Miftah Ismail added, “You have never talked about privatizing DISCOs. You have never thought about how to reduce the size of government expenditures. The IMF should have told you to give 500 to 600 billion rupees to MNAs and MPAs. They did not ask you to increase ongoing spending by 24%. The IMF said to impose taxes on agriculture and fixed taxes on retailers, which you are not doing. You are also not imposing property taxes. The IMF did not ask you to impose taxes on the salaried class.